Bankrate payroll deductions calculator

For details on specific deductions available in Michigan see the list of Michigan income tax deductions. In a larger sense investing can also be about.

Payroll Time Conversion Chart Payroll Calculator Decimal Time

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

. 41 - Michigan Standard Deduction. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Investing is the process of buying assets that increase in value over time and provide returns in the form of income payments or capital gains.

Thats because Social Security cant tax employees above a certain threshold which is 142800 for the 2021 tax year. For details on specific deductions available in Oklahoma see the list of Oklahoma income tax deductions. Make your retirement plan solid with tips advice and tools on individual retirement accounts 401k plans and more.

If you earn 60000 per year and get paid every two weeks youll be paid 24 times during the yearIf you divide 60000 by 24 youll get 2500 in gross pay each pay periodIf you quit after working 12 pay periods your earnings to date on the day you quit will be 2500 X 12 30000 You can use this same formula to calculate your net earnings take-home pay to date. Be informed and get ahead with. Using deductions is an excellent way to reduce your Oklahoma income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and Oklahoma tax returns.

The number in box 3 could also be lower than whatever appears in box 1. However theyre not the only. 41 - Oklahoma Standard Deduction.

Federal income tax and FICA tax withholding are mandatory so theres no way around them unless your earnings are very low. Because this number reflects taxable earnings before deductions were made it could be more than the amount in box 1. The IRS released the new standard deductions for 2022 which have increased from the amounts available on 2021 tax returns.

Using deductions is an excellent way to reduce your Michigan income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and Michigan tax returns.

What Is Net Income Definition How To Calculate It Bankrate

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

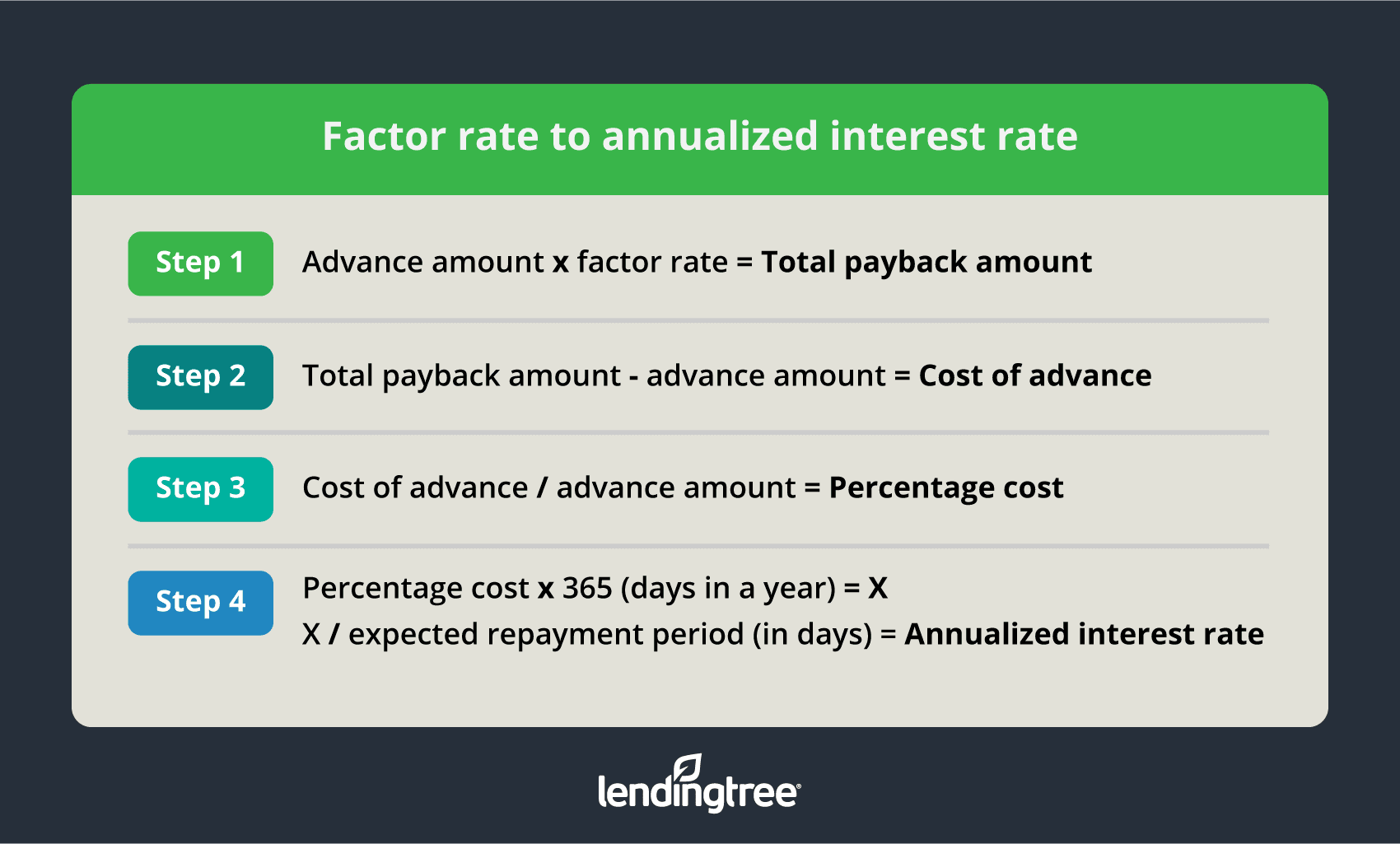

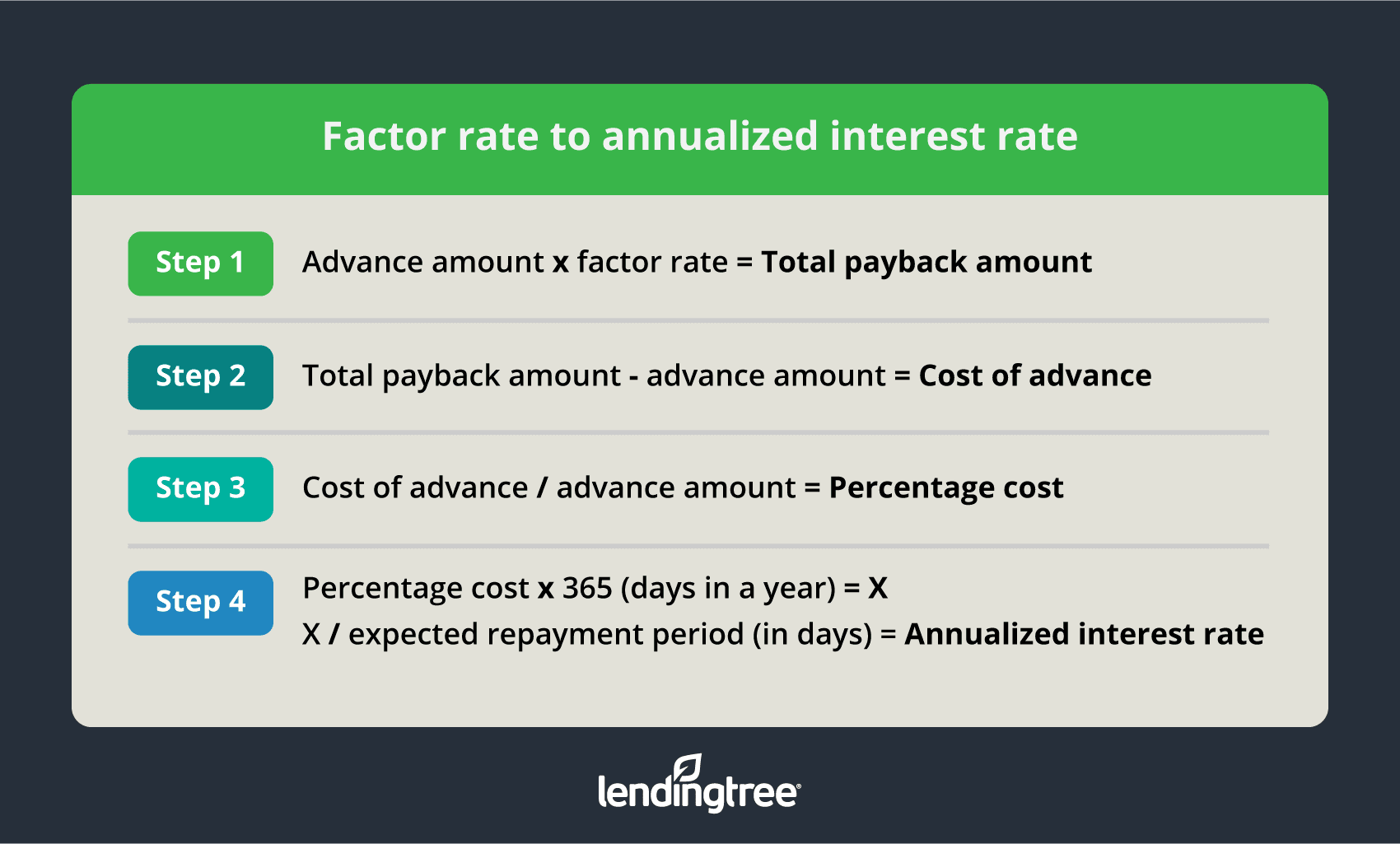

What Is A Factor Rate And How Do You Calculate It

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Taxation Services In Hyderabad Tax Debt The Motley Fool Tax Free Investments

Hire Freelance Independent Consultants Talmix Mba Co Mba Independent Consultant Hiring

How Financial Stress Affects Your Health Uha Health

Super Bowl 51 Predictions In A Game Of Inches Super Bowl 51 Super Bowl Live Superbowl 2017

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

How To Calculate Interest Rate 10 Steps With Pictures Wikihow

Paycheck Calculator Salaried Employees Primepay

Pin On 044 Investing Fintech

Easy Cap Rate Calculator Rentspree Blog

Pin On Payroll

The 4 Best Cost Of Living Calculators Ciresi Morek

Time Value Of Money Board Of Equalization